As the banking industry grows, there is a critical need for a solution that can streamline reconciliation processes and enhance operational efficiency. The challenges associated with manual Reconciliation processes and Assurance has become more pronounced.

Achieving Accuracy in Payments and Financial Reporting

As transaction volumes increase and banks expand, the inefficiencies resulting from manual exception handling became more apparent, resulting in delayed reporting, increased operational costs, and greater risk of inaccuracies or discrepancies. This problem hampers timely financial decision-making, regulatory compliance, and the overall integrity of financial reporting.

This paper outlines the key challenges and efficiency gaps observed in Data Management and Reconciliation processes within the financial services sector and proposes a solution for Automated Reconciliation and process Automation which will transform the way businesses manage their financial operations.In today’s fast-paced business environment, accurate and efficient financial management is essential for the growth and success of organizations.

Additionally, it highlights how the solution’s flexibility enables it to manage both financial and non-financial data, making it a versatile option for a variety of business needs.

Background

In 2019, digital Banks faced a unique challenge: building banking systems during the COVID-19 pandemic with a remote, hybrid workforce and low transaction volumes.

As the banks grew, transaction volumes increased, and the reliance on human resources and generic reconciliation tools wasn’t sustainable. The decision to embrace automation became crucial for scaling efficiently and supporting their future growth.

Inside The Issues

Manual reconciliation, while providing a sense of control, is often time-consuming, prone to human error, and lacks the scalability needed to keep up with increasing transaction volumes. These inefficiencies not only delay financial reporting but also increase the risk of inaccuracies, hampering decision-making, compliance, and the overall integrity of financial data. As businesses grow, there is a critical need for a solution that can streamline reconciliation processes and enhance operational efficiency.

How Automated Reconciliations Work

- Data Integration: Reconciliation software pulls data from various systems (banking, accounting, ERP systems) and automatically imports it.

- Matching Algorithms: The system uses algorithms to compare transactions based on predefined rules (e.g., date, amount, transaction ID) and automatically matches them.

- Discrepancy Identification: Any unmatched or unusual transactions are categorized and flagged for review.

- Reporting and Adjustment: The system generates reports highlighting discrepancies and may suggest or even automatically make adjustments (depending on the system’s sophistication).

The Advantages and Disadvantages of Automation

| Advantages | Disadvantages |

| Speed and Efficiency: It significantly speeds up the reconciliation process, reducing the time spent on manual tasks. | Upfront Cost: Implementing an automated reconciliation system can be costly, both in terms of software purchase and integration with existing systems. |

| Accuracy: Automated systems minimize human errors that are common in manual reconciliation, ensuring more accurate results. | Initial Setup Time: Configuring the system and establishing the necessary rules and protocols for reconciliation may take time. |

| Scalability: Automated reconciliation can easily handle a large volume of transactions, making it ideal for growing organizations. | Dependency on Technology: Relying on automation requires regular system maintenance, updates, and monitoring to ensure accuracy. |

| Cost-Effective in the Long Run: Although the initial setup cost can be high, over time, automated reconciliation can save resources and reduce the need for manual labor. | Limited Flexibility: While automation is excellent for handling standard transactions, it may struggle with unusual or highly complex cases that require human judgment. |

| Real-Time Processing: Automation can provide real-time reconciliation, allowing for faster identification and resolution of discrepancies. | |

| Audit Trail: Automated systems create an electronic audit trail, which can simplify reporting and ensure transparency and accountability. |

Addressing the Disadvantages of Automated Reconciliations

Managed SAAS Solution

Unlike many automated reconciliation solutions, iCompare overcomes several common challenges associated with implementing automation.

Signature Business Solutions offers banks a managed SaaS solution for Reconciliations, allowing the bank to avoid large upfront capital expenditures and instead pay a manageable monthly subscription fee.

How iCompare addresses the typical disadvantages of automated reconciliation:

iCompare offers a flexible pricing structure, making it suitable for businesses of all sizes. It is designed for easy integration, significantly reducing setup time. With an intuitive interface and configuration, businesses can quickly configure the system and start using it without extensive delays. iCompare also reduces reliance on constant manual monitoring by providing a dependable, low-maintenance solution. Unlike other automated systems that may struggle with complex or non-standard cases, iCompare offers flexible configuration options and advanced anomaly detection, ensuring accurate handling of irregular transactions with minimal human intervention, while maintaining its effectiveness across a wide range of reconciliation scenarios. One of the key features iCompare offers is age analysis, which helps businesses effectively manage risk. By providing detailed insights into the age of outstanding items, iCompare enables businesses to proactively identify potential issues and take timely action to mitigate risks, supporting more informed and accurate decision-making.

The previously introduced digital bank startup faced a challenge that led Signature Business Solutions to step in, offering expert resources with deep banking experience. These experts worked closely with the bank to implement best-practice reconciliation processes, all while reducing the strain on the bank’s internal SME resources.iCompare is more than just an automation tool for reconciliation; it addresses the complexities and limitations typically found in both traditional and automated systems.

Retail Bank Reconciliation Statistics

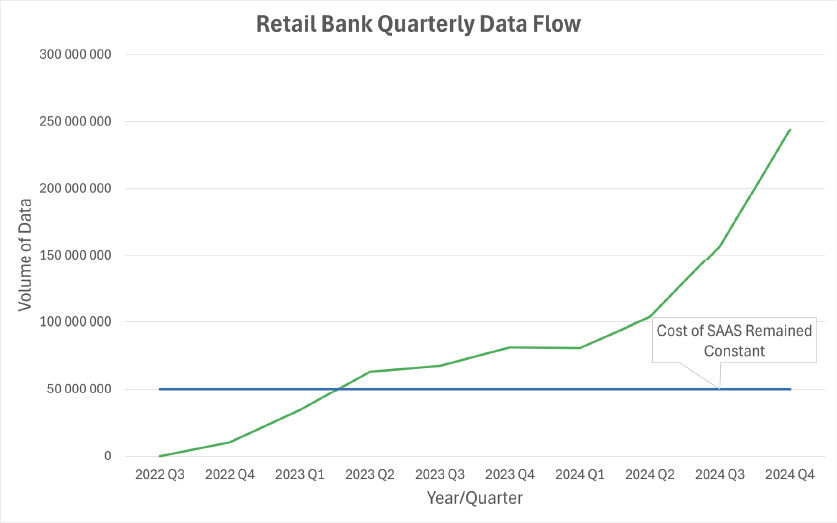

Scalability in Action:

Increasing Transactions with Stable Costs

The graph illustrates the growing volume of transactions over time, highlighting an upward trend in activity or engagement. Despite this increase in transaction volume, the cost for the SaaS solution remains stable, showing no significant rise. This suggests that the SaaS platform is able to efficiently handle an increasing workload or user demand without requiring additional costs, likely due to its scalability or a pricing model that doesn’t scale with usage.

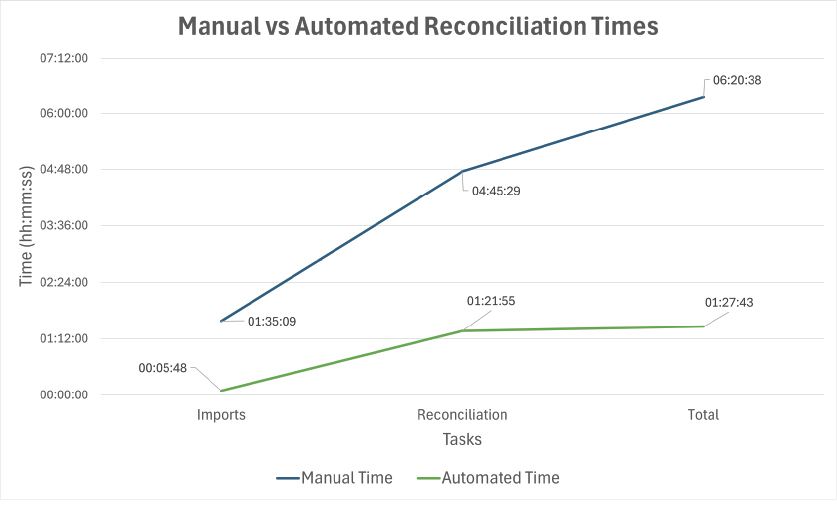

Time Efficiency:

Manual vs. Automated Reconciliation

This graph demonstrates the time difference between manual and automated reconciliation processes. It clearly shows how manual reconciliation takes significantly longer due to the need for manual data entry, cross-checking, and review, while automated reconciliation streamlines the process, completing tasks much faster.

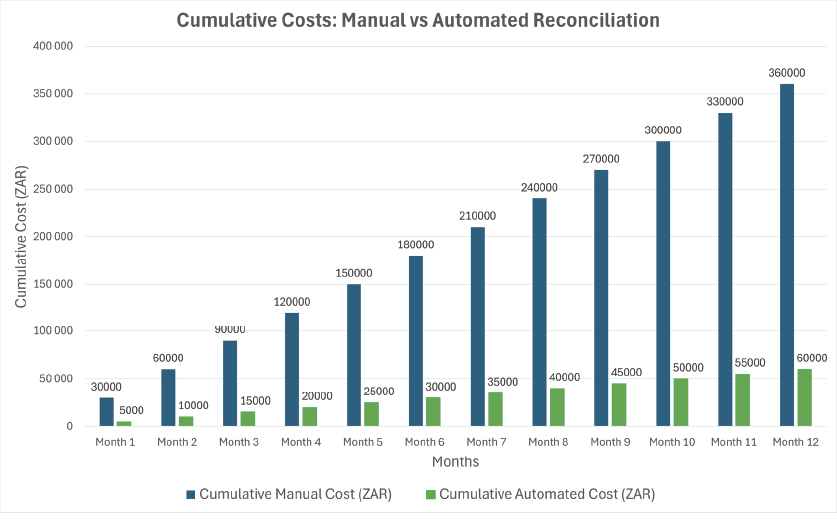

Cost Comparison:

Manual vs. Automated Reconciliation

This graph compares the costs associated with manual reconciliation versus automated reconciliation processes. It clearly illustrates how manual reconciliation incurs higher expenses due to the time, labor, and resources required, while automated reconciliation significantly reduces costs by streamlining the process, minimizing human error, and improving efficiency.

Benefits of iCompare

iCompare offers a transformative solution by automating and streamlining reconciliation tasks, enhancing accuracy, scalability, and operational efficiency. With its seamless integration capabilities, flexibility, and robust anomaly detection, iCompare empowers organizations to move beyond the challenges of manual processes and ensure more reliable and timely financial reporting. Adopting iCompare not only addresses current reconciliation pain points but also positions businesses for sustainable growth and improved financial management in the future.

- Improved Compliance

- Increased Accuracy

- Faster Financial Closures

- Time-saving

- Reduced Operational Costs